Nerd’s Guide: How to Get Started in Real Estate Investing

Getting started in real estate investing can be overwhelming. Not knowing what steps to take or what to say, it can be intimidating. It’s one of the main reasons would-be investors never get started.

From lead generation to financing to business operations, there’s a LOT of information you need to know about this business but as you get more deals done, it will all become second nature. The more deals you do, the more comfortable you’ll be.

Visit FlipNerd.com/properties to list your wholesale deals and see if there are wholesale deals near you!

The more you know about the business, the better when you’re getting started. You don’t need to be an expert, but you should be familiar with things like:

• Setting Up Your Business

• Generating Leads Consistently

• Attending Appointments and Making Offers

• Knowing Which Exit Strategy to Use

• Why Follow-Up is Crucial

• Ways to Secure Financing

• How to Automate Your Business with Systems and Tools

And the list goes on and on…

We’re breaking down the essentials that you need to know if you want to get started in real estate investing.

Setting Up Your Business

Setting Up Your Legal Entity

Talk to your local real estate attorney and explain what your goals are for your business and where you plan on investing in so that they can recommend the best legal entity for you, specifically.

The tax benefits and asset protection varies from state to state for each type of legal entity so it’s important to talk to an attorney who regularly works with real estate investors.

Create a Company Name and a Simple Logo

If you already have a company name for your real estate investing business, that’s fantastic! For those who don’t have one yet, you can search website availability by going to GoDaddy.com to see if the domain is available.

Choose a name that fits your company and is easy to remember. Bonus points if you can include anything “local” in the name, such as “North Dallas Home Buyers”.

You don’t need to spend a ton of money or time creating a logo. You can hire a graphics person to help you on sites like Fiverr.com and it can be done within a day or two.

When coming up with an idea for your logo, it might be a good idea to look up the associations that come in different colors. For example, the color green can be associated with growth and positivity while the color red can be associated with power and confidence.

A lot, and we mean a LOT of real estate investing companies use a logo with multiple houses. It relates easily to the industry but try to add a spin on it so it’s your own and when people see your logo, they immediately recognize it’s you.

Order Business Cards

Once your logo is ready, create a simple business card to hand out. Don’t make them too fancy and do NOT put that you’re the Owner/CEO/President of the company.

Why, you ask?

When you’re meeting with a seller, they don’t need to know that you have the power to make final decisions. If you’re offer isn’t as high as they’re looking for, you can let them know that you’ve provided the highest offer you’ve been told you can go.

Below is a sample business card of Mike’s for FlipNerd.com.

You can also say something similar to, “I’d buy your house at the price you’re looking for but I’d have to go back and talk to the company about it.”

When you’re attending appointments, you’re going there as the “Home Buyer” and not as the owner of a small company.

Having business cards will also come in handy as you network with other industry professionals such as other investors, realtors, contractors, title companies, real estate attorneys, CPAs, lenders, etc.

For our home buying business, American Trust Home Buyers, we keep our business cards clean and simple.

Secure Access to MLS Data

For those who are not real estate agents, getting access to MLS can be tricky but if you’re good at networking, you can find a realtor to help you out.

A lot of real estate investors will make a deal with the realtor that in exchange for MLS access, they’ll let the realtor sell any properties that they’ve rehabbed and are ready for the retail market.

Make it worthwhile for them and they’ll help you out as well.

You can also look for local services that provide MLS data. For example, in the North Texas area, we use Investway to access local MLS data.

Visit FlipNerd.com/properties to list your wholesale deals and see if there are wholesale deals near you!

Start Building Your Brand

This will happen organically the longer your business is around but you need to be very careful of the reputation you’re building as a company.

What posts are you posting on social media? Are they positive? Do they showcase your expertise or do they hint that you’re still a novice?

What about when you’re meeting with sellers? How do they perceive you? Would they recommend you to a friend?

Everything you do publicly is going to slowly form your brand.

Don’t be fake. Just be aware of how you’re coming off to others and put your best foot forward.

It can take years to build a solid, reputable brand that people talk highly of… and only seconds to tear it down.

Stay professional and build a brand that people only have positive things to say about it.

Visit FlipNerd.com/shows to watch over 1,000 podcast episodes for free!

Generating Leads

Finding Leads on a Limited Budget

It’s not uncommon for new investors to have a limited budget to work with.

When you have a limited budget, you have to do more legwork to get leads. This in many cases means driving for dollars, using door hangers, or even bandit signs.

Drive through neighborhoods you’re interested in doing deals in and when you find a property you think would make a good investment, write the address down!

You can pull up information about the property from tax records to find out the owner’s information, what they paid for the property, mortgage information, etc.

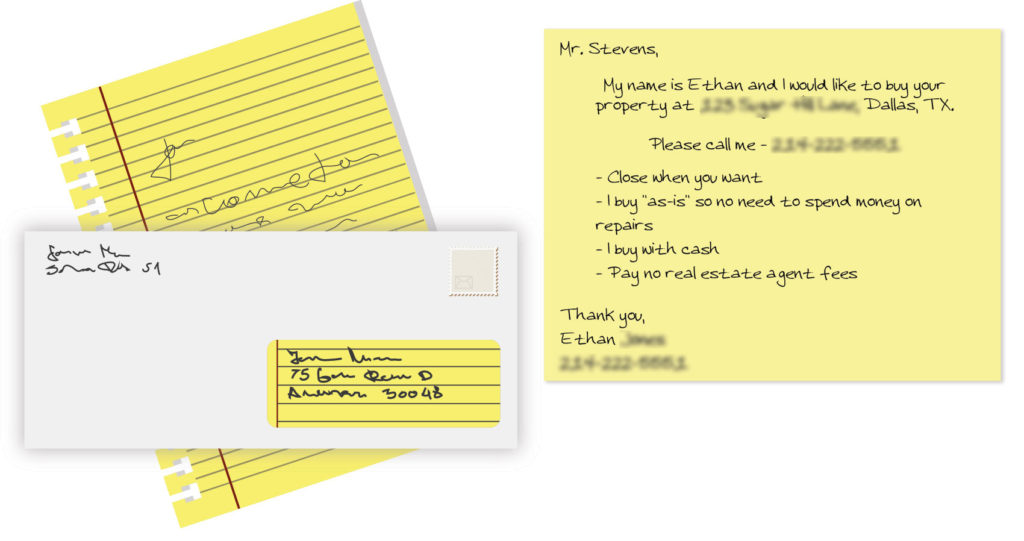

This is traditionally when an investor would write a letter on a yellow legal pad to the seller letting the seller know that they’re interested in making a cash offer on the property in ‘as-is’ condition.

These days, most yellow letters are mass produced but sellers will gravitate to pieces of mail that are written and stamped by hand. It might take more time, but it’s a cheap way to get leads calling you.

While you’re driving for dollars, have door hangers in your car so that you can leave a door hanger at any residence you are interested in. Just like your logo and business cards, you can have a design made on Fiverr.com and have it printed on Vistaprint.com.

They’re inexpensive marketing pieces that can bring in huge ROI (return on investment) compared to what was spent on marketing.

Check local and state laws regarding being able to use door hangers.

Bandit signs are not legal everywhere and we don’t recommend using them, but many investors do still use them today.

They’re great for beginning investors because they’re cheap to make and if some of them get taken away or somehow get lost, it’s not too big of a deal.

You have to be very careful with knowing when and where you’re allowed to have them posted in the city. Sometimes it’s just on the weekends and must be picked up by Sunday night at a certain time.

Regardless of any marketing you do, try to have a dedicated phone number for that marketing type so that you can track where your leads are coming from and which strategy produces the most closed deals.

Marketing Online

To start off, having an easy to navigate website is going to be one of the best things you can do when getting your business ready. These days, everyone searches online for anything they need. If they can easily find you, then they’ll reach out to you!

Have your phone number easily seen and allow them to provide their information so you can give them a call quickly. We’ll go into more depth about answering lead calls later in this guide.

Once your website is setup, make sure traffic is going there! You can easily do this through pay-per-click ads that takes sellers to your website, if your marketing budget allows for this.

You also want to make sure your website is SEO (search engine optimization) friendly. There are professionals who can help you with this or you can learn about SEO online but keep in mind that what’s working for SEO now might be different in 6 months. If done right, your website will be on the first page of Google search results.

You’ll ideally want to rank for searches such as:

• Sell my house fast in <City>

• Sell my house for cash in <City>

• Sell my house as-is <City>

• Buy my house as-is in <City>

• Cash offer for my house <City>

• Fast cash offer for house <City>

• <City> real estate investors

Social media is a valuable tool to take advantage of as well.

Get the word out to your online friends that you’re a real estate investor who can pay cash for properties that are distressed and that you’re looking for properties to purchase.

Join local real estate investing groups on Facebook so that you can network with other investors in the area. They’ll share stories, questions, experiences, and even deals.

Be sure to visit FlipNerd.com to see what wholesale properties are going up in your area.

Taking Advantage of Direct Mail

Direct mail is a great source of leads… if done right.

First and foremost, you have to make your direct mail pieces stand out.

Depending on who you’re mailing to, they likely get multiple pieces of mail from real estate investors each month, asking if they’re wanting to sell for a cash offer. This is along with other advertisement mail pieces and it’s easy to get tossed in the trash if they think you’re just another of the same.

If you have the time and are on a limited budget, writing your own yellow letter and writing on the envelope by hand can give you a high open rate because it’s a personal letter to the owner.

For those who don’t have the time for that, there are companies out there that make direct mail pieces that look very close to being handwritten. We’re talking adding doodles and having a handwritten font that could pass as being done by 100% by hand.

You have so many variables to consider and in time, you’ll be able to analyze what’s working best in your market.

Variables to consider are:

• Will you send yellow letters or postcards?

• What color should the postcard be?

• Will there be a real stamp on it?

• Will the stamp be perfectly placed or slightly crooked because it has the human touch?

• What font are you going to use?

• What color is the font?

• Will you add doodles to your postcard or yellow letter?

• Will you add anything personal to the letter so they can connect with you on a personal level?

• Will you offer a texting option in your letter or will it be strictly a phone number?

• Do you have a website to send people to? Will you add it to the postcard?

Yellow letters cost more than postcards but depending on who you’re mailing to, a yellow letter might be more appropriate.

Consistency & Follow-Up is Key

In most cases, you’re going to have to “touch” a lead multiple times before they take action.

Consider when you get mail.

If you get a mattress advertisement in the mail but you don’t need a new mattress, then you’re most likely going to toss it in the trash.

9 months later when you need a new mattress, you’re going to look for the most convenient ads.

This could be online or by mail.

You don’t want to dig around.

You want the easy solution.

Companies that are in front of you will catch your attention first.

This is why it’s a marathon and not a sprint

You shouldn’t spend all of your marketing budget in a month or two. Instead, it should be spread out over many months and as you do more deals, you’ll have the capability to scale your follow up.

If you’re doing online marketing, target (and retarget) the same audience because as they see your company ad more and more, it becomes more familiar.

After you meet with a motivated seller and they don’t take your offer, check the status of the property every week or two.

You can always call and let them know you wanted to check in to see if they had sold the house yet. As time goes on, they might become more motivated to take your offer.

If you have a virtual assistant, you can have them handle all follow-ups. They can also check tax records to see if the property has sold.

How to Handle Taking Calls

When you’re first starting out, it’s not uncommon for you, the business owner, to take lead calls.

It’s not ideal, but it’s normally short-term.

Your other options are:

• Hiring a call center to take your calls

• Let calls go to voicemail and you return calls as you’re available

• Have a virtual assistant take the calls

Obviously, you could hire locally as well, but that’s going to be one of the most costly options and when you’re getting started, it’s probably not in your budget.

When a lead calls you and you don’t answer, they’re likely to move on to the next local investor.

Getting your phone to ring isn’t cheap when you consider your advertising cost.

Don’t give them a reason to call another investor!

When deciding who should answer the phone, know that you’re going to be the most knowledgeable person but your opportunity cost is high as well.

Virtual assistants who work at least part-time for you are going to be your next best option. You can train them on what they need to find out during the call and they can quickly adapt to your business needs.

If you need to use a call center, make sure to provide them with a script to go off of and check the recordings from calls to make sure they’re being handled properly.

With a call center, they won’t have a deep understanding of your business so it’s likely that they won’t be able to answer certain questions.

For those with a full-time job and no other team members, it can be hard to answer the phone during work hours. If you decide to have it go to voicemail, customize it to give a bit of information about your company and request they leave their phone number and a brief description of the property.

Call any leads you get via voicemail back as soon as you’re able to!

Ideally, voicemail and call centers will be your backup plan or your plan for after-hours and not your main way of handling leads. Having someone answer the phone live who knows your business will always be the best option.

Need step-by-step help in getting your first deals done? Be sure to check out TheInvestorMachine.com.

Appointments

Setting Appointments

Before you start setting appointments, you need to figure out realistically how many you or your buyer can go on a day.

How large is the city you’re investing in?

In a large area like Dallas-Fort Worth, it can take over an hour to get from one side of town to the other. For this reason, we schedule our appointments at 10am, 1pm, and 4pm.

This provides enough buffer so that you have time to drive to an appointment early, check out comps nearby, attend the appointment and provide the seller with an offer, and make your way to the next location.

Every market will be different on this so don’t be afraid to customize your appointment times to fit your business.

When you’re setting up the appointment over the phone, try to get a feel for their motivation to sell and what they’re wanting to get out of the property.

You also need to set expectations and explain that you are a discount buyer and you aren’t able to pay retail for the property.

You see, you’re going to get calls from sellers who just aren’t right for your business model.

Some of these include:

• >A seller who just wants to save realtor fees

• A seller with a brand new home that doesn’t need to be repaired

• A seller who wants MORE than the retail value

• A seller who is only willing take a tiny discount

• A seller who is just curious what price you’ll offer

• A seller who has their home listed with a realtor on MLS

In most cases, leads that fit the above criteria aren’t going to take a lowball offer that you’re going to make. They just aren’t in the mindset of selling at a steep enough discount that it makes sense for you, the investor. In cases like these, they probably won’t be worth your time to go out and physically look at the property.

Instead, you can let them know on the phone a ballpark of what you’d be willing to offer without seeing the condition of the house. This will give you a better idea if they want you to come out and visit the property.

Be prepared to hear some tough situations that they’re going through and it’s important to let them know you hope to be a solution to their pain.

Sometimes when we ask about why they’re wanting to sell, it gives them an opening to divulge all the problems that brought them to the point of needing to sell the property.

Be patient. Be kind.

Offer your understanding of the situation and find a way to relate to them, if possible. This will help put them at ease and you want them to open up to you. The more you know, the better you can showcase that you’re the solution for them.

Analyzing Comps

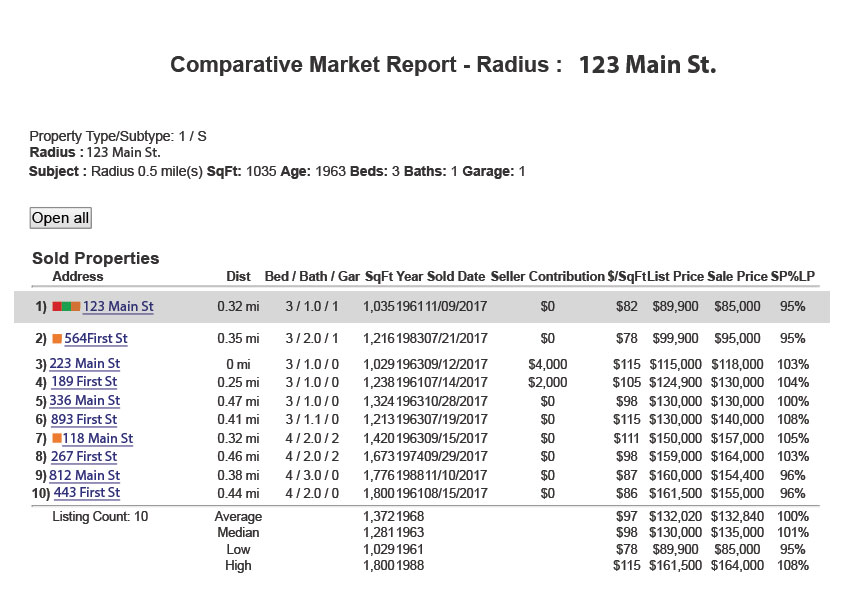

When you’re analyzing comps, you want to find the most relevant data to accurately come up with your ARV (after repair value).

Ideally, you’ll want to find other properties that:

• Have sold in the last 6 months

• Are in the same neighborhood

• Are in the same construction era (homes that have similar construction style)

• Have a total sq. ft. within 100 +/- sq. ft. of the property in question

• Same or similar features (2 car garage, 3 bed and 2 bath, etc.)

Everyone’s search criteria are going to be different.

If the above search results come up with a lot

of properties, you can narrow it down to homes

that have closed just within the past 3 months.

If there aren’t a lot of results, you might have to broaden your search criteria but be careful to analyze differences to come up with an offer that is as accurate as possible.

Be sure to look for “white elephants” within your comps as they can throw your numbers off.

For example, if there’s a property that’s the exact same square footage, layout, and neighborhood, it could seem like an excellent comp to use. When you drive by and notice it has a pool, the value of that property will be higher than yours, without a pool.

Find the 3 or more of the closest matches to the property, add the price per square foot together, and then divide by the number of houses you used. This will get you the average price per square foot.

Once you have the average price per square foot, you can multiply it by the property’s sq. ft. and come up with a good ARV (after repair value).

Attending Appointments

ALWAYS get there early to drive around and check out other comps.

While it’s smart to check comps online before you head out there, it’s hard to see any “white elephants” until you really get out there. These can include busy streets, power lines, corner lots, pools, etc. These differences can throw off your comps if you aren’t careful and you might offer too much money.

By using your closed comps you found online and your discoveries from driving around, you should be able to come up with a solid offer. (Don’t worry, we’ll talk about reading comps down below!)

You don’t need to be dressed super nice or drive a fancy car.

In fact, avoid this if you can!

They don’t need to see how successful you are at buying discounted properties! They need to feel comfortable with you.

Aim for jeans and a nice shirt with closed toe shoes, for example. If you have a shirt with your logo on it, even better. It shows you’re going out there to see the property on behalf of the company.

While we’re on the subject, bring bug spray and hand sanitizer with you to each appointment. Make sure your shoes aren’t the nicest so if they get ruined you don’t mind tossing them.

Why do we bring this up?

Because you will go into some nasty homes.

We’ve gone into houses all clean and professional and come out of there covered in fleas and who knows what else. You’re going to see stuff that will be stuck in your mind forever.

So be prepared.

When you first start talking to the seller, don’t dive right into the specifics about the house. Get to know the seller and build rapport with them. Relate to them in any way you can but make sure you’re being genuine.

Let them do the talking and be a great listener. You can ask questions to lead the discussion in the way you want to go but you’ll find the more talking they do, the more you’ll find out about their situation.

If they’re needing to get out of the property quickly, emphasize that you can buy the property as quickly as they’d like and you’ll buy the property as-is and cover all the closing costs. Let them know that they don’t have to clean the property and can leave items behind if they don’t want to deal with the hassle. Your job is to offer convenience in exchange for a discounted offer.

The key is to make it as painless as possible for them.

You should also prepare them for your offer.

Let them know why your offer is probably lower than they’re expecting (holding costs, repair costs, financial fees, closing costs, etc.) but that you can offer a quick and easy way out.

When the time comes to make an offer, you can let them know you’re going to run to your car to run numbers and get an offer together. Some investors prefer to let the seller know they have to get the offer approved by their “boss” so that they aren’t seen as the ultimate decision maker.

Even if you’re the boss of your own company, your lender could act as your “boss” in the situation because the numbers have to make sense.

Determining Repair Estimates

Labor and cost of goods are going to vary from market to market, but as you do more deals, you’ll become more comfortable with knowing how much you’ll need for repairs.

When walking through a house, if you’re in doubt if something needs to be repaired or replaced, go ahead and calculate the cost to replace.

It’s safer this way.

Regardless of if you plan on rehabbing the property, you need to accurately estimate the cost of repairs because currently, it isn’t in “retail” condition.

As you walk through the house, take mental note of the big ticket items that would need to be fixed up. We’re talking the roof, A/C unit, heater, foundation, plumbing, etc.

These items can add up quickly and if you miss them, it can eat away at any potential profit.

Talk with your contractor or other local real estate investors to see what the costs are for materials are in your area, along with labor costs. You can even walk into Lowe’s or Home Depot and see pricing for common materials you’re needing so that you have an idea.

Once you know the costs, you can create a sheet that allows you to quickly calculate repairs costs, broken down room-by-room, and item-by-item.

How to Provide an Accurate Offer

You have to be comfortable with what you’re offering. A standard is offering 70% of ARV minus repairs.

When the market crashed, investors were able to find deals in the 30%-60% of ARV minus repairs without issue. In the current state of the market, we’re seeing investors do deals anywhere from 60%-78% of ARV minus repairs.

As a business, you need to know what percentage you’re comfortable with.

After you’ve evaluated the amount of repairs needed and the comps in the area, it’s pretty simple to come up with your offer.

For our example, we’ll use 70%.

ARV (After Repair Value): $100,000

70% of ARV: $70,000

Repairs: $22,000

Our Offer: $48,000

As you can imagine, for a seller who knows their home is worth $100k, they’re going to be shocked when you tell them your offer of $48k.

This is when you need to explain to them that to get closer to the $100k offer from someone, it would need to be rehabbed and that would cost them maybe $30-40k in repairs (since they’ll be rehabbing on retail pricing where you’re rehabbing on wholesale pricing).

Don’t feel like you need to tell them how much you estimate in repairs. If they’re curious about numbers, explain some of the big ticket costs and how much they go for on a retail market, roughly.

Remind them that they would have to handle finding contractors to work with, their home would be in disarray for days to weeks, and then they would have to list it with a realtor.

Or as the alternative, you can handle fixing the property up, you can close quickly, and it’s less stress overall for them.

Hopefully, you’ve prepared them for this offer and they understand that there are costs involved with you purchasing a property in that condition.

When it comes to putting a contract together, contracts are going to vary market to market, which makes it difficult for us to talk about any specifics. We highly recommend talking with a local real estate attorney to discuss what contract you should be using for your deals.

Follow-Up is a Must!

You’re going to be told “no” a lot more than you’re told “yes” when attending appointments. It’s just part of the game.

That doesn’t mean you can’t make a good profit because the small percentage of deals you close can bring in nice, hefty profits.

After you’ve qualified the lead, met with them, and they didn’t accept your offer, don’t give up!

Some people just need more time.

Time to:

• Try to sell the property at a higher amount

• Come to terms that they need to property gone for whatever reason

• Realize that they should have taken your deal

Until the property switches ownership, you should continue to nurture the lead and send follow-ups on a consistent basis. You can call the day after the appointment and then based on the feedback you’re receiving from the seller, call or email them monthly until they no longer own the home.

If a seller says they decided to sell with someone else, you can also check tax records to see if the deal went through completely and ownership switched hands. Deals fall through all the time so you keeping an eye on it while most other investors gave up on it can give you an edge.

Visit FlipNerd.com/properties to list your wholesale deals and see if there are wholesale deals near you!

Exit Strategies

Wholesaling

Wholesaling is one of the most traditional and common exit strategies for a real estate investor. To explain it simply, you’re purchasing a property at a discount and after closing, you plan on selling it to another investor for a profit.

Wholesaling is one of the most traditional and common exit strategies for a real estate investor. To explain it simply, you’re purchasing a property at a discount and after closing, you plan on selling it to another investor for a profit.

The property most likely needs a fair bit of work but you’re selling to the other investor knowing this, so they’re going to offer lower than retail price but more than what you paid.

For example, you purchased a property for $50k and it’s worth $115k with about $15k in repairs. You closed on it and it’s now in your name (or your company’s name). You are incurring closing costs and holding costs (utilities, financing fees, insurance, etc.) but you start marketing it to your cash buyers list of other investors and mark it up to $78k.

This gives you a buffer for any of your expenses and still leaves you making probably $15-24k profit. In addition, the investor who purchases it can still make roughly $20k+ after they’ve made repairs and market it to a retail buyer who plans on living in the property.

You might ask why the initial investor didn’t just rehab the house and kept all the profit for themselves…

This is because rehabbing involves extra time, money, and risk.

Some investors prefer to do 10 wholesale deals a year compared to 5 rehab deals a year.

It’s all about your business strategy, your access to capital, and your overall strengths.

If you’re looking for Wholesale deals in your area, be sure to check out www.FlipNerd.com/properties.

Assigning

The difference between wholesaling and assigning is that with an assignment deal, you’re never actually taking ownership of the property.

Before we go any further, check with a local real estate attorney to learn more about assigning a contract to another investor as laws are different around the US.

You still meet with the seller but when it comes time to talk about your offer, you let them know the property doesn’t fit your criteria but you know a lot of other investors and with a little time, you can probably find an investor who would want to purchase the property.

You agree to a selling price and the contract is written specifically to allow you to either purchase the property or to have it assigned to another investor. (Again, talk with an attorney on this before taking action.)

For this article, we’ll say it was agreed that the property would be sold for $61k.

When you’re looking for interested buyers who are investors, you’ll mark up the property as a sort of “assignment fee” for being the middleman in bringing the buyer and seller together.

Say you find Joe N. Vestor who wants to purchase the property and agrees to pay $71k for it, you’re going to be given $10k at closing.

With each party agreeing to the price negotiated, it should be a win-win for everyone involved.

You never actually closed on the property so by going this route, you didn’t have to worry about closing costs, holding costs, and other fees associated with purchasing the property.

This works well for newer investors who don’t have easy access to funds but are willing to find the seller and the buyer.

Rehabbing and Wholetailing

Rehabbing is probably the “sexiest” exit strategy out there.

You see a nasty property that needs some serious TLC, see it get heavily rehabbed, and the investor walks away with a nice profit in the end.

It truly is fascinating to see a property become revitalized.

It truly is fascinating to see a property become revitalized.

What isn’t always shown on the fix-and-flip type of TV shows is the amount of money needed for a rehab.

You’ll have to take ownership of the property so there will be closing costs and holding costs, in addition to having to pay for the rehab itself.

Now add in the fact that if you don’t budget for your rehab correctly or the rehab takes longer than expected, the risk is considerably higher than a wholesale or assignment deal.

That being said, they can also bring in some of the highest profits.

When analyzing a property to do a rehab, make sure you’re calculating repairs accurately (see above) and make sure to have a reliable general contractor who can manage the project and keep it on schedule.

It’s going to be up to you and your business plan to determine how much rehabbing you want to do on your properties.

We’ve found the “wholetailing” method to be one of our best options lately with how hot the market is.

Wholetailing is essentially rehabbing the property just enough to be livable.

We normally give it a deep clean, replace and repair only the necessary things and market the property on MLS, letting buyers know there are repairs needed.

In the market right now, buyers don’t mind having to fix up the house if they’re getting a “good deal” on the property.

This allows for less holding costs, less risk for the repairs, and you’re able to close on the property quicker and move onto the next deal.

Rental Properties

Rental properties are perfect for the long-term investing game.

While you’re working to pay them off, they might only be cash-flowing a small amount, but as you buy more of them and start to pay them off, your monthly cash-flow can be huge!

Rental properties work best when you have multiple.

Why is this?

- If you have 1 property and it’s vacant for 2 months, that can be a heavy hit to your business. If you have 8 properties and a property is vacant for 2 months, the other 7 properties help lessen the impact and you won’t feel it so much.

- With 1 property, it’s easy to say you’ll manage it yourself (although you can have a property manager set up for this as well). This means being on-call 24/7 and having to deal with termites, toilets, and tenants. As you scale, it’s easier to outsource to a property manager and have it dealt with for you.

- You might be making $100-300 in cash flow after all expenses each month for 1 property. Once it’s paid off you’ll be cash flowing $1,000-1,500 (for example. When that’s multiplied by 10 or 25 or 100 properties, that’s BIG money, each and every month.

Try to get in the mindset of a tenant and consider what they’d be looking for. A 3-bedroom property that isn’t too big or too expensive will most likely hit the widest range of tenants. Go bigger or smaller and you’re going to drastically reduce your net to a small number of potential tenants.

Every time you have a tenant move out, you’re most likely going to have to freshen the property up before you can rent it out again. This could just be touching up paint and a deep clean or it could mean heavier repairs.

With tenants, many of them have a “renter’s mindset”, meaning that they know the property is only temporary for them and they don’t take the best care of it.

Some investors provide a “lease-to-own” option which provides the tenant with the option to purchase the property later down the road.

Most tenants don’t end up buying but while they’re living there, they’re taking great care for the property since they have an “owner’s mentality” and they sometimes even do their own improvements.

For those interested in rental properties but don’t want to deal with the stress of sourcing the properties, managing the rehab, locating tenants, or collecting the rent, Passive Rental might be a good option.

PassiveRental.com is a turnkey provider that will allow you to be a passive investor versus an active investor.

The term turnkey means that they source distressed/discounted properties from banks and motivated sellers in targeted neighborhoods. They then rehab each property to make it rental-ready. As soon as the rehab is complete, they place a tenant in the property and secure a signed lease.

The properties are managed by their local/in-house property management and they sell the completed (rehabbed and leased) properties to investors as performing assets. If you’re interested in learning more, visit PassiveRental.com

Securing Financing

Hard Money Lenders

Hard money lenders are great for short-term needs such as wholesale and rehab deals.

The interest rates they offer are usually the highest around, but since these are short-term loans, many times you’re only paying the interest. This allows you to not have a ton of money tied into the deal, making it easy for newer investors to get started.

These loans are asset-based loans and don’t require much money or personal credit as they’re lending based on the equity position of the deal.

Government/Conventional Loans

Government, or conventional loans are perfect for rental properties!

You have to meet certain criteria such as around a 45% or lower debt-to-income ratio, good credit, work/income history, and the ability to put 20% down on the property.

With Fannie Mae and Freddie Mac, you can have up to 10 financed properties.

Private Lenders

Private lenders are going to be your friends and family.

Have an uncle who’s sitting on a nice stash of cash and wants to invest it?

You can provide him with higher returns than any bank would! It’s important to work on an interest rate that’s fair to the both of you.

They’re perfect for wholesaling and rehab deals as their money won’t be tied up too long.

It’s important to show that you’re serious about investing, that you’ve done your research, and know what you’re doing!

Get a feel for them and see how passive they’d like to be in the investment. Some want to get status reports of progress being made while others just want to know when they’ll get their money back.

Always follow through and pay them back quickly so that they’re more likely to invest with you time and time again.

Community Banks

With community banks, you’re going to be better able to form a relationship with them, as compared to a national lender.

They’re usually more investor-friendly and can find a loan that suits your specific needs.

You’ll want to meet with them in person and discuss your business and your goals. Let them know the type of investing you do, what houses and price points you look for, and share your success stories.

They want to see that you’re reliable.

Need step-by-step help in getting your first deals done? Be sure to check out TheInvestorMachine.com.

Relationships

Lenders

Finding the right lender is crucial in your business because it will make everything go smoother.

When you’re thinking of building your team, having a lender or two that understand your business and can get your loans done quickly will be beneficial. They aren’t an internal team member but they’re very much a necessary team member, unless you plan on paying cash for every deal.

Title Company

Right along with lenders, title companies can make it either extremely easy or difficult to get a deal closed.

It will take them a few deals to get a good understanding of your business needs but they are another valuable asset when you’re trying to close deals quickly.

Mentors and Coaches

If you’re looking for step-by-step guidance for your first few deals, it can be helpful to take on a mentor or coach.

If you’re looking for step-by-step guidance for your first few deals, it can be helpful to take on a mentor or coach.

Find someone who has been doing deals, ideally locally, for multiple years and knows the niche you’re wanting to get into. If your main focus is going to be wholesaling and rehabbing single-family homes, you don’t want an expert who only handles multi-family, for example.

Your mentor should be able to help support you and guide you as you start meeting with sellers and getting deals done. Knowing that you have someone to talk through a deal with gives you the confidence to get deals you otherwise wouldn’t have gone through with.

Learn from their experiences and you’ll be able to jump-start your business and lessen your learning curve.

Real Estate Attorneys

While you won’t need a real estate attorney too often, it’s a good idea to have a local real estate attorney to seek advice from when needed.

They can help you set up your business entity, including figuring out what type of entity makes the most sense for your particular business. The last thing you want is for someone to sue you and your properties or personal assets be at risk.

Laws for assignment deals and bandit signs, in particular, vary from market to market so it’s smart to discuss your business plan with them so that your actions are legal.

CPAs/Accountants

The majority of real estate investors aren’t the best in accounting and tax preparation. This is why it can be best handed off to someone much more knowledgeable on the topic.

Talk to other local investors and see if they have a recommendation for a CPA or accountant who understands the real estate investing business.

Depending on what exit strategies you’re doing, there are tax advantages that you don’t want to miss out on just because you chose the wrong CPA.

Contractors

Once you find a good general contractor that you enjoy working with, doing everything you can to keep them because the wrong contractor will cost you both time and money.

Always ask for recommendations from other real estate investors as it can be helpful when you’re creating your list of sub-contractors and companies to use for your rehabs.

When you’re trying to find the right general contractor for your rehab jobs, go visit their current projects and see how they’re managed. You can learn a lot by observing a job site and you want a general contractor who has good control of his sub-contractors.

Realtors

Building a relationship with a few realtors in the area can be beneficial for both sides.

The realtor can give you a heads up if they know of any deals that would work for your numbers, including deals that aren’t yet on MLS. Sometimes they run into distressed properties that aren’t ready to go on MLS.

In return for them bringing you deals, you can have them list any of your move-in ready properties on the MLS and make a commission off of them.

It can be a win-win if done right.

Other Investors and Wholesalers

Not only can you do deals with other investors, but they can also be a great source of knowledge. Finding out what strategies they’re using or recommendations for different companies can be very helpful when you’re just starting out.

REIA meetings can be most helpful for this. You’ll get to usually hear from a speaker and also have time to mingle and talk with other real estate investors.

Slowly, you should start building your cash buyers list, which will largely include other real estate investors in the area. If they’re looking to purchase deals at a discount, let them know you’ll contact them when you have a deal that might work for them.

Need step-by-step help in getting your first deals done? Be sure to check out TheInvestorMachine.com.

Tools and Systems to Help with Automation

Podio

Having all of your leads stored in one location is crucial. With Podio, we have every single lead in there, along with important information.

This includes:

- Phone number

- Physical address

- Communication reports

- Meeting reports

- Offers made

- Repair estimates

- Status of the property

- Photos

- Contracts

We want to track everything that happens between the lead and us. If you need to set a reminder to call them next month, a task can be created as a reminder. If we get it under contract, all the information leading up to the contract along with the contract itself will go in there.

It’s the go-to for any status report regarding a lead of yours.

Asana

We actually use the free version of Asana and it works fantastic! It’s our task management system and our entire team uses it daily.

You can set up individual tasks for yourself or create projects for the entire team. It’s clean and easy to use and provides excellent visibility to the team.

We have a project template in Asana for assignment deals and rehabbing deals, for example, that have over 70 tasks that need to be completed from start to finish.

This allows us to see what’s been done from other team members and with due dates in place, holds us accountable for finishing on time. In the beginning, it’ll be you handling most tasks but in time, you’ll be able to delegate various tasks to your team as it grows.

Creating a template for important parts of your business such as marketing or going on appointments can be helpful as it’s easy to overlook the small tasks.

Dropbox

Having cloud-based storage allows you to easily access your files from any device.

We organize our dropbox by address so that we can have all documents for a particular property in one, easy to access location. From before/after photos of the property to buy contracts, sale contracts, and listing information.

Visit FlipNerd.com/shows to watch over 1,000 podcast episodes for free!

QuickBooks

QuickBooks (or similar) is a great tool to help you manage and track your business expenses and profits.

On a business level, you can enter all of your expenses for the business, including:

- Marketing expenses

- Gas expenses (from traveling from appointment to appointment)

- Any payroll

- Office supplies

- Commissions

- Profits/Losses from deals

- Education costs

It’s a good idea to periodically analyze the accounting side so you know how the business is performing. For example, if you’re spending $8,000 a month on marketing but you’re only bringing in an average of $5,000 in profit a month from deals, you need to make some adjustments.

It’s easy to look at the profits you’re making on deals and say you made XX amount of money from one deal. When it comes down to the real numbers though, you need to account for your expenses and QuickBooks allows for this transparency.

When you get a deal, everything needs to be entered into QuickBooks so that you can accurately see the end profits. This includes:

- Cost of the property from HUD

- Closing costs

- Commissions

- Repair costs (labor and materials)

- Interest from financing

- Marketing costs

- Utility costs

- Insurance

- Sold price

If you add every expense between closing on the property and selling the property, you’ll be able to easily see your gross profit for that particular deal.

Handling the bookkeeping is not a strength of most real estate investors. QuickBooks or other similar systems can make tracking easier but it has to be done accurately and completely for it to work.

Your Own Website

Having a website that motivated sellers can easily find will help get your phone ringing!

It doesn’t have to be complicated but it should have:

- Information about you and the business

- Testimonials from those who have sold to you

- Your phone number

- Your email address

- Benefits of working with you

- Where you buy

As your website is being built, it’s important to make sure you’re building it to be search engine friendly and when people search for cash buyers in your city, your website is showing high in the results.

Don’t worry.

If that sounds scary to you, it’s easy to hire someone to help with your online presence.

InvestorCarrot builds websites for real estate investors that are search engine friendly.

They can help add blog posts, set up keywords specific to your market and your business, and make an easy-to-navigate professional site for you.

Email Autoresponder

When someone submits their information on your website, you can have an email autoresponder send them a quick, personalized message from you.

This can let them know when they can expect you to call and any other important information to make you stand out from other investors.

Phone Systems

Sure, your cell phone will work for a while. You always have it on you and it would be easy to send all traffic there.

When you want to track your different marketing strategies, it’s a good idea to use a different phone number for each strategy so you can see where your leads are coming from.

By doing this, it will help you fine-tune your marketing and make your dollar stretch further.

Systems like CallRail enables you to have various phone numbers that ring to a given phone. It’s a web-based phone system that tracks the calls and has the ability to record the calls if that’s legal in your state.

Even better is that you can set it up so that after so many rings, it goes to your back up option. This might be a virtual assistant or a call center, for example.

Call Centers

Call centers are not usually the first choice but instead an option for when no one on your team is able to answer a call. Ideally, it would be you, a local team member, or a virtual assistant who’s answering the calls.

You have to decide if you’d rather have a call go to voicemail or if you’d rather have it go to a call center that will read off a script and don’t really know your business.

Many investors use call centers for after-hours.

Get Started… Sooner Rather than Later

It’s easy to say that you need to learn more or save more money before you start investing.

Excuses are easy to make.

Those excuses are putting wedges between you and your goals.

Set up a plan for what steps you’re going to take in order to complete your first deal. Think of every small task you can do and as you accomplish these tasks, celebrate your small successes.

If you need help, don’t be afraid to get a mentor!

They can help you avoid making beginner mistakes and can help get your business off the ground quicker than on your own.

Don’t put a limit on your success.

Put the hard work in and get ready to reap the rewards.

Need step-by-step help in getting your first deals done? Be sure to check out TheInvestorMachine.com.